Are you looking for a new car and have perhaps already seen an interesting offer from a Swiss leasing provider? The attractive leasing rates often sound like a very good deal that you shouldn't miss out on. But what is behind the advertised leasing rate? What is it made up of, are there any other costs you should be aware of and might a car subscription be a better alternative for you? Find out in the following blog article.

How is the leasing instalment calculated in Switzerland?

If you want to calculate a lease and find out how much it will cost for your dream car, you will often start by looking at the leasing instalment. This is paid monthly and is made up of the following factors, among others.

Model and specification

The monthly leasing instalment is based on the gross list price of the car. This is calculated according to the model, configuration and optional extras you choose. If you opt for more expensive configuration, such as many assistance systems and a more powerful engine, the gross list price of the car will increase.

Residual value

In principle, the residual value is the value of the car at the end of the leasing period. The calculation is based on factors such as the purchase price, the leasing term and the number of kilometres covered. In general, the higher the residual value of a lease, the lower the expected value loss of the car and therefore the lower the lease payment.

Contract term and KM package

The length of the contract also influences the price. In most cases, a lease can be taken out for between 1 and 4 years. The contract term is fixed in advance. At the beginning of the lease, you also decide on the number of kilometres. This is usually between 10,000 and 30,000 kilometres per year and often cannot be changed once the contract has started.

Interest rate

The interest rate on a leasing contract can vary greatly depending on the provider. It is therefore worth comparing. Some Swiss lessors also offer a so-called 0 % leasing. What initially sounds like an interest-free offer often comes with hidden costs or additional fees.

Down payment

A down payment is a one-off payment made at the start of the lease. It is deducted from the price of the vehicle being financed. This reduces the financing amount and the monthly lease payment is lower than without a down payment.

For example, if you pay CHF 10,000 at the start of a 24-month contract, the leasing instalment will be approximately CHF 416 / month lower than if youlease without a down payment (CHF 10,000 / 24 months). However, the total cost is not lower. You simply decide to pay part of the amount up front (down payment) rather than spreading it over the months.

Please note: The leasing instalment is only part of the total costs

Anyone who has ever taken out a leasing contract knows that the monthly payment is only part of the total cost.‘For the effective monthly costs, you have to calculate with three times the monthly leasing instalment,’ says the media spokesperson for Touring Club Switzerland (TCS). This may seem a little high at first, but on closer inspection it is quite realistic.

The TCS bases its car leasing calculation on the numerous additional costs that arise in addition to the leasing instalment. These include the following:

Compulsory fully comprehensive insurance

Regular maintenance and service costs

Repairs and tyre changes

The annual vehicle tax

Cantonal redemption costs

Administrative fees, if applicable

Calculating car leasing - a sample calculation including total costs

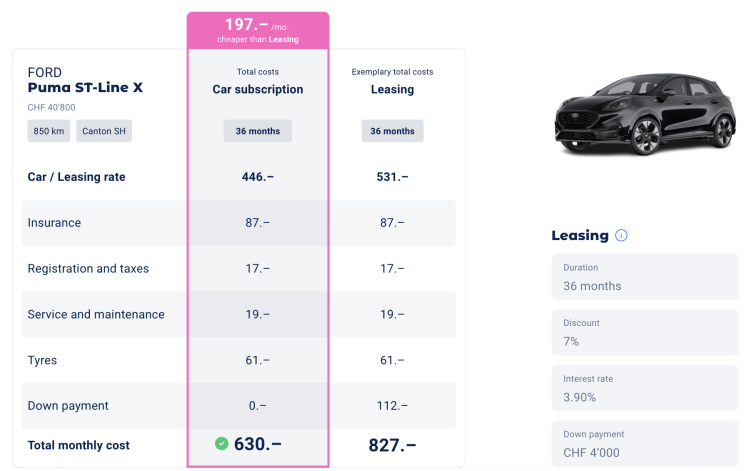

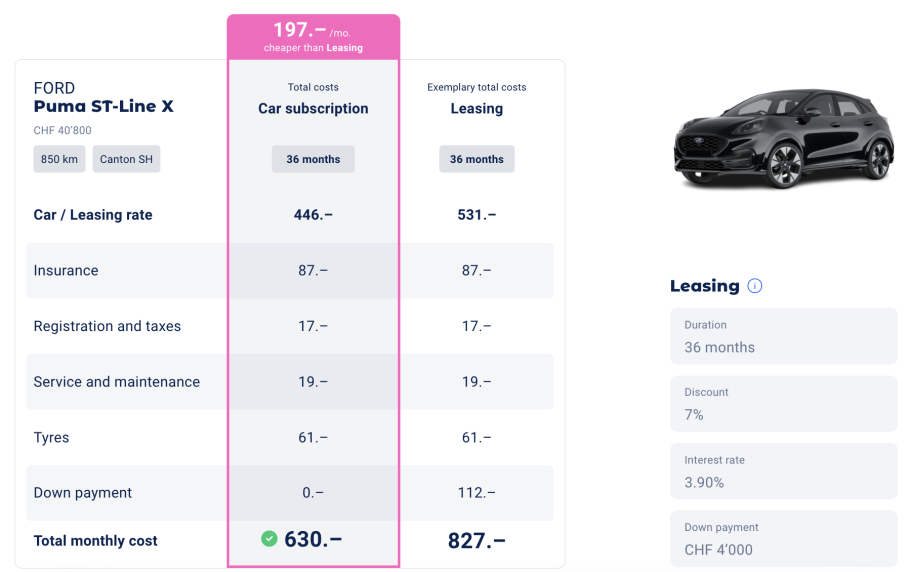

To get a better idea of the total cost of leasing, let's take a practical example. Important: The calculation was made in July 2024 and may no longer be accurate. For up-to-date examples, see our individual cost comparison.

Let us assume you are interested in leasing a Ford Puma ST-Line X. The new price of your dream car is CHF 40,800 (as of 07/24).

You would like to lease the car for 3 years, drive about 15,000 km per year and are from the canton of Schaffhausen. You go to your local car dealer and even get a 7% discount on the list price. The salesman prepares a leasing offer: You have to make a down payment of CHF 4,000 and have an interest rate of 3.9%, resulting in a leasing instalment of CHF 531.- / month. This sounds tempting at first.

However, if you add the additional costs mentioned above, such as insurance, registration and taxes, service and maintenance, tyres and the down payment to the monthly instalment, the total cost comes to CHF 827.- / month (see photo).

Carvolution car subscription: the transparent alternative to leasing

Easier, more transparent and more affordable is the Carvolution car subscription. The customer pays a fixed monthly total price, in the case of the Ford Puma ST-Line X a comparatively favourable CHF 630.- / month (see photo).

Carvolution's All-in-One subscription includes not only a wide selection of vehicles, but also insurance, registration, taxes, service, maintenance and tyres in one monthly price. Thanks to large order volumes and a lean organisation, Carvolution can offer more attractive conditions overall, which you as a customer benefit from.

In addition, you can flexibly adjust the kilometre allowance on a monthly basis, so you don't run the risk of paying dearly for extra kilometres or overpaying for your low-mileage car.

If this sounds interesting, and you would like to compare the cost of a car subscription with the total cost of leasing your dream car without obligation, you can do this with the individual cost comparison. Simply send us your leasing offer, and we will compare the price with our car subscription. This will give you an accurate overview of the total price of the different mobility options.

If you are interested in a car subscription but are not sure whether it is right for you, our experts will be happy to provide you with a non-binding consultation.

Car with all-inclusive subscription

Insurance, registration, taxes, and more – everything included. Around 40 models from various brands.